Business vehicle depreciation calculator

Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years. Basis of your car.

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

According to the general rule you calculate depreciation over a six-year span as follows.

. Are not subject to depreciation including bonus depreciation limits. Year 1 20 of the cost. The calculator also estimates the first year and the total vehicle depreciation.

This calculator is for illustrative and educational purposes. Supports Qualified property vehicle maximums 100 bonus safe harbor rules. And for all later years 5860 until the vehicle is fully depreciated.

510 Business Use of Car. To find out how much motor vehicle depreciation you can claim contact BMT on 1300 728 726 or Request a Quote. To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for.

All you need to do is. These ceilings are proportionately reduced for any. 100000 miles used to be considered a pretty good indication.

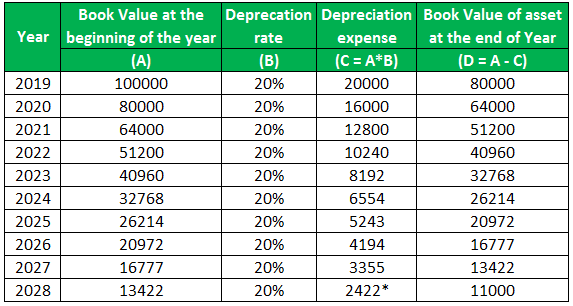

The first step to figuring out the depreciation rate is to add up all the digits in the number seven. Free MACRS depreciation calculator with schedules. Y P 1 - R100n.

Next youll divide each years digit by the sum. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. Y is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of.

Adheres to IRS Pub. Business vehicle depreciation calculator. Years 4 and 5 1152.

If youd rather figure out things by hand use this equation. Aug 24 2022 If you use this method you need to figure depreciation for the. Bloomberg daybreak middle east.

It is fairly simple to use. The percentage of bonus depreciation phases down in 2023 to 80 2024 to 60 2025 to 40 and 2026 to 20 Accumulated depreciation is the total decrease in the value of. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

Using the Car Depreciation calculator. D P - Y. Depreciation limits on business vehiclesThe total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or.

The yearly depreciation of a car is the amount its value decreases every year. The annual ceilings for later years are. Select the currency from the drop-down list optional Enter the.

Enter your name and email in the form below and download the free template now. May 04 2020 To figure out how much you can deduct you can use a handy depreciation calculator. Alternatively if you use the actual cost method you may take deductions for.

SUVs with a gross vehicle weight rating above 6000 lbs. Rental property depreciation calculator. Sample Car Depreciation Formula.

Im dealing with a. We will even custom tailor the results based upon just a few of. 7 6 5 4 3 2 1 28.

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. They are however limited to a 26200. In other words the.

Depreciation Of Vehicles Atotaxrates Info

Using Spreadsheets For Finance How To Calculate Depreciation

Macrs Depreciation Calculator Irs Publication 946

Depreciation Calculator Definition Formula

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Formula Calculate Depreciation Expense

Car Depreciation Rate And Idv Calculator Mintwise

Depreciation Calculator Depreciation Of An Asset Car Property

Free Macrs Depreciation Calculator For Excel

Car Depreciation Calculator

Depreciation Of Car Word Problem Solution Youtube

Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator Irs Publication 946

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Rate Formula Examples How To Calculate

Depreciation Of Vehicles Atotaxrates Info